Amid the COVID-19 pandemic, we understand that your insurance company is looking for a quick way to close down and take your business activities digital. You need a turnkey solution that will be affordable and easy to implement. We offer a digital platform that you and your employees can use at home. You don’t need any experience writing code to make this happen in a matter of days!

The key is pursuing a digital transformation that makes sense for the size of the organization and the types of services you wish to provide now and in the next two years. Most importantly, don’t throw your money away because you get fooled by marketing hype.

What is a digital transformation?

There are different ways to describe this evolution of your organization. On a company-wide level, you’re going to examine all existing processes that impact customers and determine how to offer the same types of transactions or better ones using digital applications. In some cases, digital transformation means human tasks become fully automated. In other cases, digital transformation means employees use applications to complete their tasks faster and with more information at their fingertips.

An insurance industry example

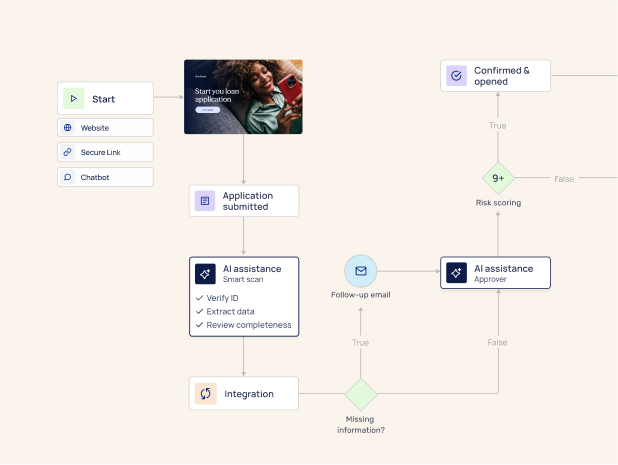

You create a web form customers can fill out to update their insurance policy. If this is provided on a digital platform, it can easily be connected to your existing database. Your employee could go through the customer’s submission and make edits instead of manually entering the changes. However, with a digital platform, the form could make suggestions to the client about their policy based on the data that’s being entered, such as indicating the price of a higher policy limit. This type of automation and level of customization enhances the consumer’s experience and saves the employee time.

Before purchasing a digital platform, it’s best to meet with your management team and conduct a digital needs assessment, including these steps:

- Identify what essential customer experiences you would like to achieve through the first stage of digital transformation.

- Rank these experiences in order of importance.

- Select the top experiences for the first stage of transformation.

- Identify any gap that exists between the current business model and the target customer experience.

- Choose a solution that helps you close the gaps in the top targeted experiences in one shot.

What to look for in a digital platform

It’s a given that going digital will cause disruption throughout your company. However, the end result will make your organization less vulnerable to the competition because you will be streamlining business processes to meet consumer needs. Here are 4 things you should look for when selecting the best digital platform:

Quantity

Due to ever-changing regulations at both the federal and state levels, insurers and banks are finding themselves having to produce, reproduce, and edit a massive amount of required client forms. Whether it’s a policy proposal, an insurance application, a policy amendment, or a prospectus, it’s something that must be reviewed by an employee and scanned for future retrieval. When you use a digital solution like EasySend, your company can significantly reduce the number of forms and make it easy to fill them out and store them. If there is an update to be made, an existing form can be changed and saved in the cloud-based database. The catch is that your client database must meet current federal and state security standards to protect consumer information from data breaches.

Quality

Let’s face it. Many insurers and banks in the U.S. have slowly developed into large and complex enterprises. They are slow to complete their digital transformation because they are often crippled by legacy systems and inefficient processes. The result is that customers don’t enjoy their experiences. With EasySend’s no-code platform, plug-and-play solution, any insurer can become more adept at processing multiple client forms, which improves the customer experience and elevates overalls satisfaction to a new level. Your insurance company must invest in a solution that brings legacy systems into the digital age (even if it means replacing them).

Cost

We live in a world where the potential ways you could invest in digital transformation would exceed your IT budget if you purchased them all. Whenever you adopt a digital solution, ten more options emerge on the market promising to perform the same processes and more with greater efficiency. Although many large insurers and banks have deep pockets, their spending is under constant scrutiny from regulators, distributors, and customers. Generally, the priority of the insurer is always ensuring that you have healthy cap reserves, general account surplus, product embedded value, policyholder or contract owner dividend, etc. EasySend can help enterprises improve their top-line value (earnings) by reducing the direct and indirect costs of manual form production and the form management. We’ve also planned to manage the many risks associated with manual document processing, including errors, non-compliance, and client attrition.

Time to market

It used to be feasible to wait for 8 to 12 months for the release cycle of a new digital product. Now, if you were to wait that long, your customers would abandon your brand. Today’s insurers should consider solutions that deliver unique digital experiences to their clientele with greater speed. EasySend uses advanced AI (artificial intelligence) and no-code application development capabilities to reduce development time from months to days. Our solution also reduces maintenance costs and simplifies operations. You won’t need any programmers to update business processes with EasySend, but your CTO will find it easy to implement this platform across your organization. Choosing EasySend would be a crucial and impactful step in your digital transformation.