Insurers are advised to adopt a multifaceted approach, including digitization and automation in claims processing, to improve CRs. However, automation alone is insufficient. AI in identifying systemic losses, subrogation, salvage opportunities, and fraud prevention can significantly impact profitability.

One way to do this is to improve the efficiency of customer data intake. A digital customer data intake process can help insurers save time and money by automating the data entry process. This can free up resources that can be used to improve other areas of the business, such as claims processing or customer service. In addition, a digital customer data intake process can help insurers to capture more accurate and up-to-date customer data. This is because digital data entry methods are less likely to result in human error.

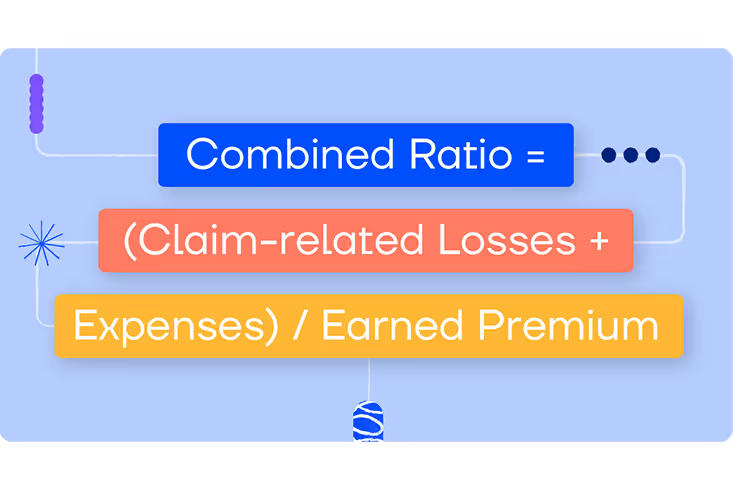

What is a combined ratio, and how is it calculated?

The combined ratio is calculated by adding claims losses plus expenses, divided by the total premiums collected. A combined ratio of less than 100% means an insurer is profitable. Anything over 100% indicates a loss.

[.emph]Combined Ratio = (Claim-related Losses + Expenses) / Earned Premium[.emph]

P&C insurance trends 2024

It’s estimated that in 2024, the combined ratio for P&C insurers will continue to rise. This is due to a number of factors, such as an increase in frequency and severity of natural catastrophes, as well as an overall increase in claim activity. Here are some trends that are expected to impact combined ratios in 2024:

1. Entering the hard market

The property and casualty (P&C) insurance industry in 2023 has faced significant challenges, as reflected in the combined ratio, a key indicator of profitability.

P/C growth has improved in 2023, growing 1.3% versus 2.1% for overall gross domestic product (GDP). While many hurdles could derail such improvements, P&C underlying economic growth is currently positioned to increase faster than overall GDP by 2.6% versus 1.7% in 2024 and by 4.5% versus 2.0% in 2025. Source

A September 2023 report from Fitch Ratings estimates that the U.S. commercial auto insurance segment’s combined ratio (CR) will exceed 106 percent in 2023, further noting that the segment has posted a CR of over 100 percent in 11 of the last 12 years. The only exception was 2020, when pandemic-related lockdowns factored into a noteworthy decline in commercial auto liability claims.

This represents a worsening from the previous year's ratio of 102.6 and remains above the 100.0% breakeven point for underwriting profitability. The deterioration in the combined ratio can be attributed to several factors including high catastrophe losses, particularly in homeowners insurance, and challenges in the personal auto line.

Claims have risen due to recent events such as the pandemic, inflation, war, and natural disasters. In response, insurance providers must increase premiums to stay afloat.

- Fitch Ratings estimates the U.S. commercial auto insurance segment's CR will exceed 106% in 2023, continuing a trend of over 100% CRs in 11 of the last 12 years, except for 2020 when pandemic lockdowns reduced claims.

- The latest projections from the Insurance Information Institute (Triple-I) and Milliman forecast a net combined ratio of 103.8 for the industry. This figure is partly driven by severe convective storm losses, which have been the highest in decades.

- An analysis of nine publicly traded personal auto insurers showed that only Progressive and GEICO had CRs under 100%.

- The Insurance Information Institute projects the industry's average CR to be above 102% for 2023, while Swiss Re is more optimistic, forecasting an improvement to 100% in 2023 and 98.5% in 2024.

- Factors like natural disasters, inflation, supply chain, and labor shortages in mechanics significantly affect CRs.

This situation highlights the P&C industry's vulnerability to external economic and environmental factors and the need for strategic approaches to enhance profitability and manage risk.

Analysts expect the hard market to persist due to multiple factors

- An increase in frequency and severity of natural catastrophes

- An overall increase in claim activity

- A rise in expenses, such as reinsurance costs

- Pressure on investment income

In terms of specific lines within the industry, different segments show varying levels of performance:

- Personal lines are projected to see some improvement each year from 2023 through 2025 but will still lag behind in terms of strong underwriting profitability when compared to commercial lines. The net combined ratio for personal auto is expected to incrementally improve to 110.5 in 2023, from 112.2 in 2022. However, costlier replacement parts and low inventories contribute to current and future loss pressures in this segment.

- The homeowners segment is also facing challenges, with the net combined ratio forecasted at 110.9 for 2023, which is 6.2 points worse than in 2022. Approximately 70% of the losses in the first half of 2023 were in the homeowners line, influenced by elevated catastrophe losses.

- On a more positive note, commercial property, general liability, and workers' compensation continue to be bright spots for the industry. The net combined ratio for commercial property is forecasted at 91.6 for 2023, nearly identical to 2022. Workers' compensation, in particular, is expected to continue its string of underwriting profits through 2025, with a net combined ratio forecast of 90.6 for 2023.

- Commercial auto, however, remains a troubled area, with underwriting losses continuing and the combined ratio forecasted at 106.7 for 2023.

This data underscores the varied performance across different lines within the P&C industry. While segments like commercial property and workers' compensation exhibit resilience, overall industry trends indicate challenges and a lack of underwriting profitability for 2023.

2. Focusing on writing profitable policies

As the market continues to harden, insurers are focusing on writing profitable policies. To do this, they will need to have a clear understanding of which policies are most likely to result in a loss. They can then use this information to either avoid writing these types of policies altogether or to price them appropriately.

Data analytics is playing an increasingly important role in helping insurers to identify and assess risk. By using data analytics, insurers can gain a better understanding of their customer base and the risks they face. This information can then be used to develop more effective underwriting criteria.

3. Improving operational efficiency

As insurers focus on writing profitable policies, they will also need to find ways to improve operational efficiency. One way to do this is to automate repetitive and time-consuming tasks, such as customer data entry. Automation can help insurers to free up resources that can be used to improve other areas of the business, such as claims processing or customer service.

4. Focusing on policyholder experience

Policyholders now have more choices than ever before, and they are increasingly likely to switch providers if they are not happy with the service they receive. As a result, insurers need to find ways to differentiate themselves from the competition. One way to do this is to focus on the policyholder experience. By providing a seamless and positive customer experience, insurers can stand out from the crowd and win more business.

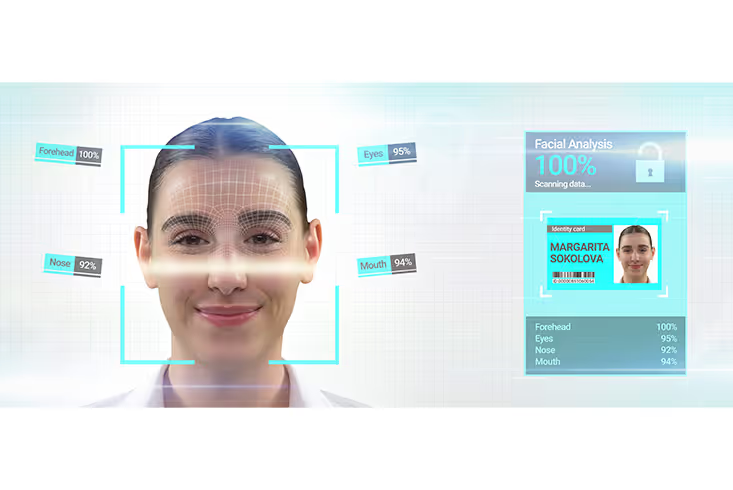

5. Improving fraud detection and prevention

Fraudulent claims cost the insurance industry billions of dollars every year. As a result, insurers are under pressure to find ways to improve fraud detection and prevention.

Data analytics can play a vital role in helping insurers to identify fraudulent claims. By using data analytics, insurers can gain a better understanding of claim patterns and the types of fraud that are most commonly committed. This information can then be used to develop more effective fraud detection and prevention strategies.

6. P&C insurers need to focus on technology

Technology is playing an increasingly important role in the insurance industry. Insurers are using data analytics, and artificial intelligence (AI) to improve underwriting, claims processing, and customer service. In order to stay competitive, insurers need to invest in the latest technology and make sure that their employees are properly trained to use it.

The insurance industry is facing a number of challenges

The insurance industry is facing a number of challenges, including the need to improve operational efficiency, the hardening market, and increased competition. However, by focusing on the areas outlined above, insurers can overcome these challenges and position themselves for success in the future.

So how can insurers stay ahead of the curve? The key is to focus on improving your company's profitability. Here are four ways to do that:

- Use data analytics to identify and assess risk

- Automate repetitive and time-consuming tasks

- Focus on the policyholder experience

- Improve fraud detection and prevention

By focusing on these four areas, insurers can improve their bottom line and position themselves for success in the future.

Improving profitability and reducing combined ratios with digital data intake in 2024

The focus on profitability will be even more important in 2024 as the industry enters what is known as the ‘combined ratio correction’. It is imperative that insurers focus on improving their bottom line in order to not only survive, but to also thrive during this time.

There are three ways to improve your profitability and cut the combined ratio: increase premiums, reduce claim losses, and reduce expenses.

Reducing claim losses

Reducing losses can be difficult, but there are some things you can do to lower claims payouts. One way is to focus on prevention. This means improving risk management and safety protocols to help prevent insurance events from happening in the first place.

Underwriting strategies are another way to lower claim losses. This includes using data and analytics to identify high-risk customers and either declining to insure them or charging them higher premiums.

Reducing operational expenses

Another way to reduce losses is to reduce your expenses by improving your efficiency. This means streamlining the way you collect customer data and getting rid of paper-based processes.

Customer data collection remains a labor-intensive and paper-driven process for most insurers, often involving manual data entry of customer information. This inefficient process leads to errors, resulting in overpayments or delayed payments. It also creates a bad customer experience, as customers have to wait longer to receive their payouts.

Operational inefficiencies lead to inflated costs, especially in call centers where customer service representatives (CSRs) spend much time on the phone trying to gather information from policyholders.

According to a recent study, automating customer data intake in insurance can reduce call center operating costs by 30% (source: iii).

Reducing loss adjustment expenses

Loss adjustment expenses (LAE) are the costs associated with processing claims. They include expenses such as investigating and adjusting claims, as well as legal and defense costs. LAE can be reduced by automating the claims process and making it easier for customers to submit their information. The main reason for this is that digital data is more accurate than manual data entry, so there are fewer errors.

In addition, digital data intake makes it possible to collect data from multiple sources, which can help improve the accuracy of claims. For example, if a customer is submitting a claim for a car accident, you can collect data from the police report, the insurance company's database, and the customer's own records.

This information can be used to help adjusters make better decisions about how to settle claims, which can lead to savings for the insurance company.

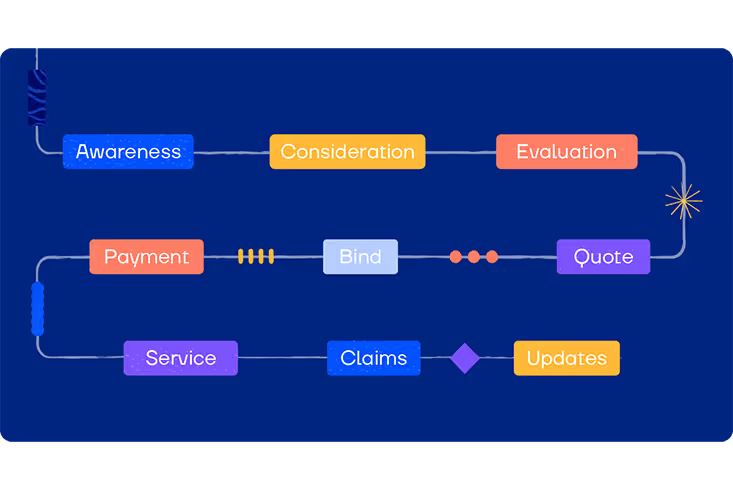

Increasing premiums by digitizing quote and bind processes

Improving quote-to-bind times, making it easier for customers to submit their information, and using data and analytics to help identify upsell and cross-sell opportunities will help you write more business. Improving digital capabilities to make it easier for customers to do business with you will help you write new business and keep your existing policyholders.

Improving quote-to-bind ratio with digital customer data collection

The quote-to-bind ratio is the number of quotes that turn into binding policies. A high quote-to-bind ratio means that your company efficiently converts quotes into business. A low quote-to-bind ratio indicates problems in the quoting process, which can lead to lost business. There are several ways to improve your quote-to-bind ratio, but one of the most effective is to make it easy and seamless for customers to submit their information.

A digital platform makes it easy for customers to submit their information and speeds up the quoting process. It also allows you to pre-fill forms with data from other sources, which reduces the chances of errors. Digital data collection also makes it easier to identify upsell and cross-sell opportunities, as you can see what products customers are interested in and offer them related products.

Identify upsell and cross-sell opportunities

Digital data is essential for insurance companies to identify upsell and cross-sell opportunities and automate customer communications. Upselling is the process of selling a more expensive product or service to a customer, while cross-selling is the process of selling a related product or service.

For example, if a customer buys a life insurance policy, you might upsell them by offering an annuity or a rider. Or, if they buy a car insurance policy, you might cross-sell them by offering a homeowners insurance policy.

Data and analytics can help you identify which products customers are interested in and offer them related products. Digital data intake ensures that you have accurate and up-to-date data, which is essential for effective upselling and cross-selling.

Using digital data collection to improve combined ratios

The combined ratio is a measure of an insurance company's profitability. Maintaining profitability in a hard market requires disciplined underwriting, accurate modeling of individual risks in portfolios, diversifying lines of business, and using reinsurance to limit potential losses.

Ten ways digital data intake improves profitability in insurance

- Reduces the cost of customer data collection

- Improves data integrity and accuracy of customer data

- Makes automation downstream possible

- Reduces fraud and boosts underwriting profits

- Transforms the customer experience

- Helps identify upsell and cross-sell opportunities

- Deflects to self-service from your call center

- Improves the quote-to-bind ratio

- Automates customer communications

- Allows for real-time customer segmentation

The property and casualty (P&C) insurance industry is expected to face continued challenges in 2024 due to a combination of factors including inflation, supply chain disruptions, and increased geopolitical risks.

As combined ratios come into focus in the hardening market, insurers are turning to digital data and analytics to help improve their combined ratios. Digital data intake makes it possible to collect data from multiple sources, which can help improve the accuracy of claims. For example, if a customer is submitting a claim for a car accident, you can collect data from the police report and the insurance company's database,

It also requires transforming customer data collection processes to reduce costs and boost premiums. A digital data platform can help insurance companies improve their combined ratios by making it easier to collect accurate data, identify upsell and cross-sell opportunities, improve the quote-to-bind ratio, and automate customer communications.

EasySend is a no-code platform that helps insurance companies improve their combined ratios by making it easy to collect accurate data and automating customer communications. With EasySend, you can quickly transform your customer data collection processes to boost profitability and improve the customer experience. Schedule a demo today to see how we can help you improve your combined ratio.

.avif)

.avif)

.avif)

.avif)