Call centers are a major part of any industry, including banking and insurance, but they aren’t exactly the most customer-friendly model of communication and service. We’re talking long wait times, frustrated customers, agent burnout, and error-prone manual processes. These are just a few of the reasons why call centers are ripe for digital transformation.

Thankfully, there’s a simple solution that can transform call centers from something that frustrates customers to something that delights them. With digital intake, your company can significantly boost the customer experience you offer and with it, increase your brand loyalty and revenue.

Customer experience is in, traditional call centers are out

There’s no getting around it: In 2022, customer experience is one of the most important factors to an organization’s success or failure. 73% of consumers say that customer experience is a deciding factor when making purchase decisions and 80% believe that the experience a company provides is just as important as its product or services. That’s why brands that improve their customer experience can increase their revenue by 10 to 15%.

[.figure]80%[.figure]

[.emph]of customers believe that the experience a company provides is just as important as its product or services[.emph]

If your company still uses the traditional call center model, this should be a wake-up call. Simply, the traditional call center simply doesn’t deliver a good customer experience (and that’s putting it gently). Call centers require customers to wait out long hold times, listen to lengthy automated menus, speak to monotone agents reading from a script, and repeat their information again and again. It’s irritating at best and infuriating at worst. No wonder 50% of customers believe that most companies’ customer service needs to be improved.

How digital intake can improve the customer experience

One major factor slowing down call center calls is the time it takes for agents to manually input information given to them by customers on the phone into their systems. Not only does this take a long time, but it’s also highly susceptible to errors, such that customers often end up having to make repeat calls.

Rather than requiring an admittedly error-prone human call agent to input important customer data, digital intake allows for a much more effective process, putting more control into the hands of the customer.

How it works

“G as in golf… U as in umbrella… T as in tank. No, tank, not bank!”

With digital intake, the days of customers losing their patience (and their minds) as they have to spell and re-spell their names again are finally over. Instead, they’re able to have a much more efficient and tolerable (maybe even pleasant!) experience.

Here’s how it goes:

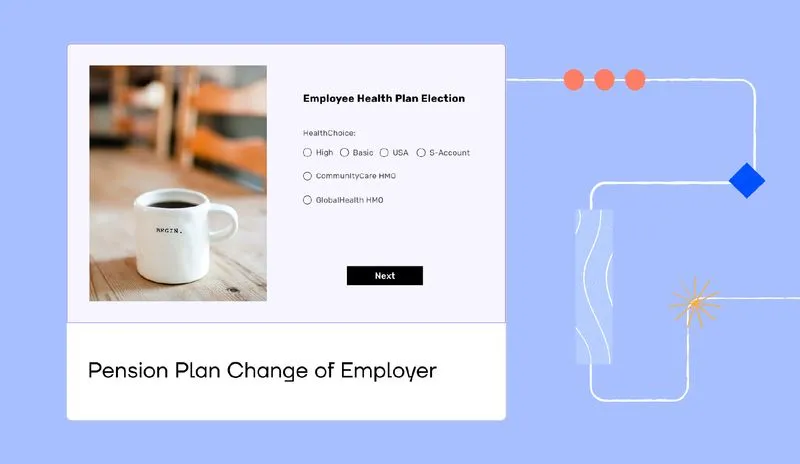

- A customer calls into the call center to make their claim and get connected to an agent. The agent sends them a self-serve link to a digital data intake journey that they can open on any device they have available to them, including the phone they’re speaking on.

- The customer is then taken through an interactive, easy-to-use process during which they input information, upload documents, and securely sign. It’s all optimized for UX, designed to offer them the best possible experience.

- On the company’s side, the data is then automatically populated into their systems, allowing them to easily proceed to the next stage, helping the customer solve their issue with accurate, updated information.

With the digital data intake journey, the customer gets to get off the phone faster, with minimal frustration. Processing time and the number of errors made goes down - and with them, so does the overall length of each ticket, as well as the need for follow-up calls.

Tips for implementing digital intake in your call center

It might sound overwhelming, but with the right forethought, planning, and tools, digitizing data collection in your call center can be relatively simple, with incredible results.

It’s important to approach the process in a methodological and strategic manner, breaking it down into several stages.

Here are a few tips:

- Break the intake process into stages, classifying your customers into different categories

- Categorize the most common reasons for calls, then create customized digital experiences for each use case

- Start with the most difficult scenarios - solving these will help you solve the major complexities at the go, and the rest will flow from there

- Prioritize! Use your data to determine the most crucial areas that require digital intake and start there

- Make sure your call center agents are properly educated regarding the new intake method

The benefits of digital intake for customers

This digitized intake process has a number of benefits for companies and your customers.

Because today’s customers are quite clear on what they’re looking for. 62% of customers report that they prefer personalized products or services. 70.5% prioritize convenience over other factors such as brand - and this figure is only higher for younger generations. And 67% of customers prefer to use self-service for their needs.

With digital intake, customers get a significantly improved experience that gives them what they want. Their interaction is more personal and customized to their specific needs, so they only see what they need - nothing more and nothing less. It’s digital and mobile, available to them on their device and in their own time, so they don’t have to feel rushed or slowed down. The user experience is painless and seamless, and customers feel more secure knowing the correct information was recording. And while the customer can lead the process, they’re not left alone: a call center agent is still there to guide them through the process and provide real-time support when needed.

Benefits of digital intake for businesses

Of course, what’s good for the customer is good for the insurance company. 73% of companies with above-average customer experience perform better financially than their competitors. And that same number of consumers say that a good experience is key in influencing their brand loyalties, making them five times more likely to make a repeat purchase and four times more likely to refer a friend to the company.

But the benefits of digital intake also go beyond just what it can offer customers. In switching to the self-service model of digital take intake, insurers can expect to see:

- Lower processing times

- Reduced claims costs

- Fewer data entry errors

- More use of agent’s time

- Fewer follow-up calls

- Automation of the claims process

- Ease of implementation and use

- Easier, faster customer care

Although the word “digitization” may come with associations of needing to hire costly developers to create a lot of complex code, that is actually a misguided assumption.

Today, low-code and no-code solutions allow anybody with basic computer skills to easily create digital customer journeys. If you can drag and drop, you can create a digital intake process for your insurance call center. It’s fast, budget-friendly, and flexible, easy to adjust or scale as needed. Now, there’s no reason not to transform your customer experience into one so positive that your entire business will see the benefits.