In the rapidly evolving landscape of the insurance industry, Chief Information Officers (CIOs) are at the helm of steering their organizations towards digital excellence. A critical aspect of this digital transformation journey is enhancing the customer experience, particularly through the process of digital onboarding.

This initiative not only serves as the first touchpoint in the customer's journey but also sets the tone for the entire customer lifecycle. In this blog post, we delve into the transformative power of digital onboarding in the insurance sector, exploring its impact on customer satisfaction, operational efficiency, and competitive advantage.

A significant portion of consumers (69%) express a desire for new ways of accessing products and services, signaling a shift towards more digital offerings and smoother online sign-up processes. However, the complexity of identity verification processes can deter potential customers: 83% of consumers are discouraged by complicated sign-up procedures, and 60% would abandon the process if identity verification takes more than 40 seconds.

The strategic imperative of digital onboarding

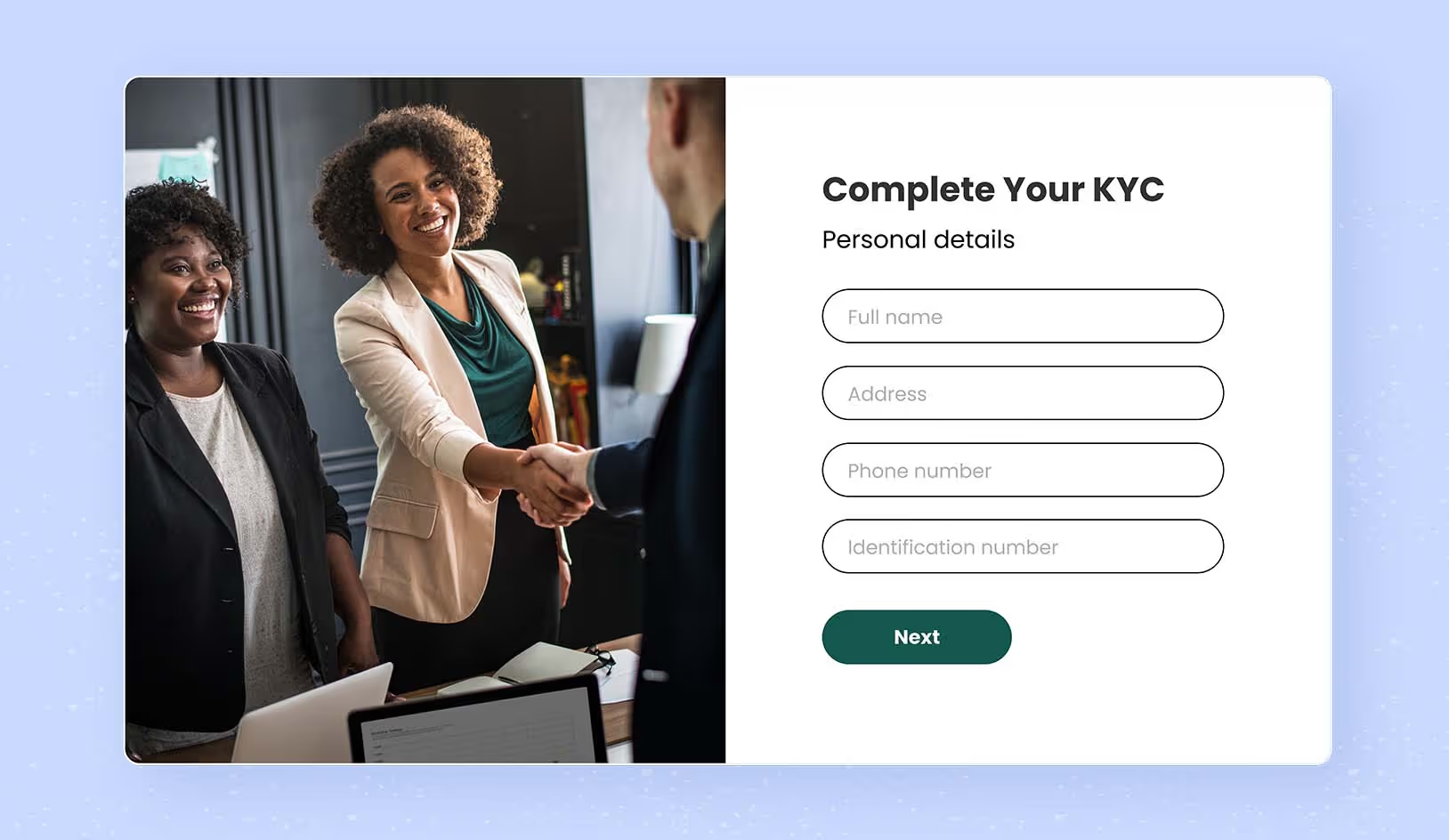

To address these challenges, insurers are turning to sophisticated identity verification solutions that can authenticate identities quickly and accurately, using technologies such as real-time photo or video analysis for facial matching, including liveness detection. This not only speeds up the onboarding process but also enhances security and compliance, creating a balance between user convenience and the need to protect against fraud.

Moreover, digital onboarding allows insurers to collect more accurate and detailed customer data, enabling them to personalize their offerings and improve the overall customer experience.

The impact on customer satisfaction

With digital onboarding, customers can complete the entire sign-up process from anywhere at any time, eliminating the need for in-person appointments, calls to the customer service, or paper-based forms.

Customers expect interactions with their insurance providers to be as streamlined and intuitive as those with leading tech companies. Digital onboarding meets these expectations head-on by offering a frictionless, convenient, and highly personalized experience.

By leveraging technologies such as AI-driven chatbots for initial queries, biometric authentication for secure access, and personalized recommendation engines for policy selection, insurers can significantly enhance customer satisfaction and loyalty from the outset.

Operational efficiency and cost reduction

Digital onboarding not only elevates the customer experience but also brings substantial operational efficiencies. Manual, paper-based onboarding processes are notoriously time-consuming and error-prone, leading to higher operational costs and customer dissatisfaction.

Automating these processes reduces manual intervention, accelerates the onboarding timeline, and minimizes errors. This automation, in turn, translates to cost savings and allows staff to focus on more strategic tasks, such as customer service and product development.

Competitive advantage in a crowded market

In a market saturated with traditional and emerging insurance providers, standing out is paramount. Digital onboarding offers a unique opportunity to differentiate through innovation. By adopting the latest digital technologies and tailoring the onboarding experience to the needs and preferences of today's tech-savvy customers, insurers can position themselves as forward-thinking leaders. This differentiation is critical not just for attracting new customers but also for retaining existing ones in an increasingly competitive landscape.

Navigating challenges and ensuring compliance

Implementing digital onboarding solutions presents its own set of challenges, including ensuring data privacy, meeting regulatory compliance, and integrating with legacy systems. Insurers must carefully navigate these challenges to deliver a seamless and secure onboarding experience. Failure to do so can result in customer distrust, reputational damage, and potential legal repercussions.

To address these challenges, insurers must work closely with technology partners and regulatory bodies to develop robust security protocols and systems that comply with relevant laws and regulations. They must also regularly review and update their processes to stay ahead of any potential risks or vulnerabilities.

The future of insurance onboarding

The insurance industry is constantly evolving, and digital onboarding is no exception. As technology continues to advance, insurers must be prepared to adapt and innovate their onboarding processes to stay competitive.

Digital onboarding is not just a technological upgrade but a strategic enabler of customer satisfaction, operational efficiency, and competitive differentiation. By prioritizing the digital onboarding experience, insurers can not only meet but exceed the expectations of their digitally native customers, fostering loyalty and driving growth in the digital age.