Just like P&C and health insurance, life insurance submissions have typically been a long, drawn-out process for policyholders. However, life insurance differs from other lines of insurance in that it requires a thorough understanding of the lifestyle of the insured and the client's life-stage specific needs. Policyholder needs also evolve over time, requiring insurance companies to continuously update the customer experience and offerings, or risk losing customers to competition.

From submissions to underwriting and claims, insurance companies have traditionally relied on manual processes and paper forms for life insurance sales and customer service. Even today, life insurance applications can take weeks (or even months!) to process. Moreover, the claim process in life insurance is even more challenging, with beneficiaries having to go through extensive paperwork and verification during the time of a devastating personal loss.

And while life insurers have long understood the importance of efficient customer journeys, many are still dealing with outdated systems filled with manual touchpoints that aren’t designed to accommodate digital submissions.

But times are changing — insurance companies must embrace digital submissions to deliver a modern life insurance customer journey.

Digital data intake in life insurance policy lifecycle

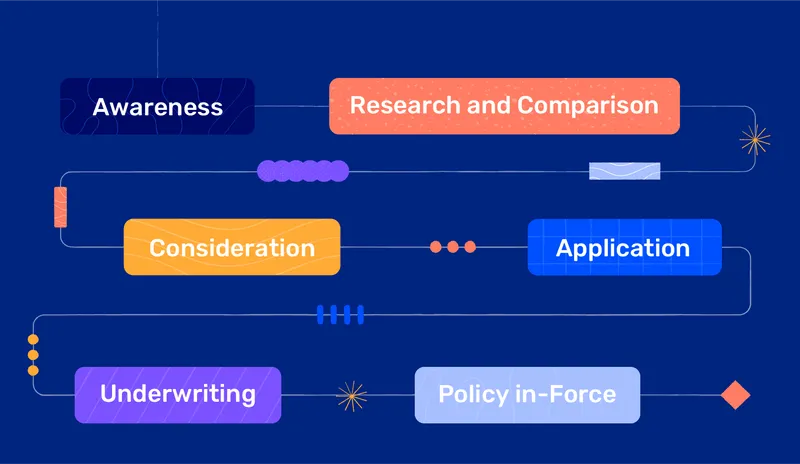

Agent/broker-driven life insurance sales have been the industry norm for decades. The first step in life insurance sales is to capture customer data and documents, a task traditionally completed with paper forms, and then to send it to carriers for an underwriting decision.

This process is often manual, slow, and error-prone, with inefficient back-and-forth communications between agents, carriers, and policyholders.

Moreover, the underwriter may request additional documents and information during the life insurance underwriting process. This can cause customers to become frustrated with a clunky life insurance customer journey, leading them to delay or even change their minds about the purchase altogether.

Fortunately, life insurers have an opportunity to provide a seamless customer experience through digital submissions. By utilizing digital technology, insurance companies can provide customers with a faster and more convenient experience.

Insurance companies that embrace digital submissions also have an edge in terms of speed and accuracy. Digital forms make it easy for customers to quickly enter information, streamlining underwriting processes and reducing turnaround time. Moreover, digital submissions enable life insurers to gain access to critical customer information in real-time, ensuring accurate quotes and faster policy delivery times.

Benefits of digital submissions & digital claims in life insurance

Digital submissions enable life insurers to move faster and more accurately. For life insurers, this translates into quicker quotes, fewer errors, and improved customer experience. Digital submissions also help life insurers reduce operational costs associated with manual paperwork processing and streamline the life insurance underwriting processes.

Digital forms enable life insurers to streamline underwriting processes, reduce turnaround time and costs associated with manual processing. According to recent research, life insurers that have embraced digital submissions have seen up to 83% reductions in underwriting time. Moreover, life insurers can capture customer data and documents faster and more accurately with digital forms.

Digital submissions also enable life insurers to provide customers with improved claims experiences. Digital forms make it easier for beneficiaries to submit information quickly and accurately, reducing turnaround time on claims while providing a better customer experience.

In addition, life insurers can benefit from increased customer loyalty and retention. Life insurers that adopt digital submissions and digital claims processes will be well-positioned to meet their customers’ changing needs in the future. Digital forms provide life insurers with an opportunity to build relationships with customers by providing an adaptable life insurance journey that is personalized to customer needs.

Digital claims are especially beneficial for life insurers as they streamline administrative costs and improve speed and accuracy. Moreover, digital claims enable life insurers to provide the highest levels of customer service through personalized communication and automated updates about claim status.

Digital submissions are the necessary stepping stone for implementing advanced technologies. From chatbots to automated underwriting, life insurers that embrace digital submissions will be well-positioned to meet the changing needs of life insurance customers and capitalize on the latest innovations.

Finally, life insurers that embrace digital submissions will also be able to tap into additional sources of information from customers and other external data sources. This enables life insurers to gain a deeper understanding of their customer’s needs and develop more tailored life insurance products and services at each stage of life.

No-code digital submissions empower agile life insurance digital transformation

Insurers must embrace digital submissions if they want to remain competitive. By transitioning the life insurance policy lifecycle to digital submissions, life insurers can provide customers with a modern customer experience.

Digital submissions not only simplify life insurance sales and claims processes but also improve customer experience, reduce costs, and enable life insurers to develop more tailored life insurance products and services.

One way to quickly implement digital submissions is to use no-code solutions, which enable insurers to quickly set up forms without needing a lot of technical expertise. This allows life insurers to bring the customer journey into the digital age with minimal effort.

Ultimately, digital submissions are revolutionizing the customer experience and helping life insurers stay ahead of their competition. By embracing digital submissions, life insurers can provide a seamless journey that enables customers to quickly and easily obtain life insurance products and services. Life insurers should capitalize on the opportunity to embrace digital submissions if they want to remain competitive.