Today the insurance industry faces a significant challenge: optimizing document workflows to enhance efficiency, security, and customer satisfaction. A key solution to this challenge is the integration of digital signatures into insurance document workflows.

The Urgency for Digital in Insurance

The insurance industry, traditionally reliant on paper-based processes, is under increasing

pressure to digitize due to growing consumer demands for speed, convenience, and security. Digital signatures, legally recognized in many jurisdictions, offer a powerful tool to meet these demands by enabling the electronic signing of documents from anywhere, at any time.

Global ESignature Trends

Integrating digital signatures into insurance document workflows not only streamlines operations but also aligns with global trends in digital transformation. The digital signature market, valued at USD 3.92 billion in 2022, is projected to soar to USD 43.14 billion by 2030, showcasing a remarkable CAGR of 35.1%. This growth underscores the increasing demand for digital signatures across various sectors, with the BFSI (Banking, Financial Services, and Insurance) segment demonstrating significant expansion due to the shift toward digital platforms to enhance customer services.

In North America, the digital signature market was valued at USD 1.62 billion in 2022, with an expected CAGR of 35.7% from 2023 to 2030. This region's dominance is attributed to its early adoption of digital technologies, bolstered by legal frameworks like the U.S. Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Meanwhile, Europe is projected to hold the largest market share during the forecast period, largely due to its robust regulatory framework, including the eIDAS regulation, which provides a clear legal framework for digital signatures, and GDPR for data protection.

The digital signature market is experiencing growth driven by strategic partnerships and acquisitions among key players, such as Adobe, DocuSign, Thales, and Zoho, aimed at expanding product portfolios and enhancing market reach.

These trends and developments highlight the growing importance of digital signatures in the insurance industry, offering opportunities for enhanced efficiency, security, and customer satisfaction.

Benefits of digital signature integration

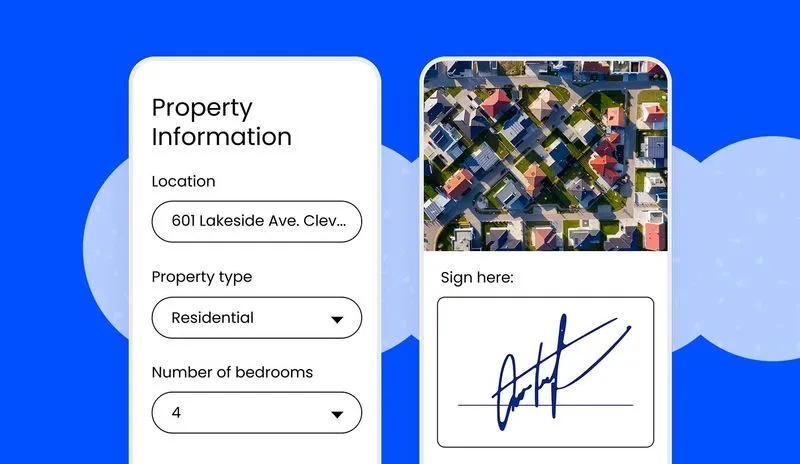

Integrating digital signatures into dynamic customer data intake workflows represents a fundamental shift in how organizations manage document signing processes within their broader digital transformation strategies.

This integration streamlines operations, enhances security, and improves customer experience by making the signing process more efficient and accessible. Here's an overview of how digital signatures tie into dynamic customer data intake workflows and the principles behind integrating these solutions.

Enhancing efficiency and security

Digital signatures reduce the time and resources required to process documents. By integrating digital signatures with dynamic workflows, organizations can automate the routing of documents for approval and signing, significantly speeding up processes that traditionally require manual handling. This automation not only accelerates operations but also reduces the risk of errors and improves document traceability and integrity.

Improving customer experience

Incorporating digital signatures into customer data intake workflows allows customers to sign documents electronically from anywhere, at any time, using any device. This flexibility eliminates the need for physical paperwork, making processes such as onboarding, claims handling, and contract renewals much smoother and more user-friendly. It reflects a commitment to customer convenience, directly contributing to higher satisfaction levels.

Streamlining compliance

Digital signatures ensure that documents are signed in compliance with legal requirements. They provide a secure, verifiable way to capture consent or agreement, complete with audit trails for tracking and verification purposes. When integrated into dynamic workflows, digital signatures help organizations maintain compliance with regulations automatically, reducing the legal and financial risks associated with non-compliance.

Facilitating multi-channel data collection

Dynamic workflows often involve collecting data across multiple channels and touchpoints. Integrating digital signatures into these workflows ensures that the signing process is seamlessly embedded into the customer's journey, regardless of the channel. This holistic approach to data collection and processing streamlines operations and ensures consistency in customer interactions across all platforms.

Considerations for integration

- Legal Compliance: Ensure that the digital signature solution complies with relevant laws and regulations, such as the ESIGN Act in the United States or eIDAS in the European Union.

- Technology Compatibility: The chosen digital signature solution should seamlessly integrate with existing document management and workflow systems to avoid disruptions.

- User Authentication: Implement robust authentication methods to verify the identity of signatories, enhancing the security and integrity of the signed documents.

- Accessibility: Choose a solution that is accessible across various devices and platforms, ensuring that all parties can easily sign documents regardless of their technological setup.

Principles of Integration

As the market continues to evolve, insurance companies are encouraged to adopt digital signature technologies to remain competitive and meet the increasing demands of digital-first consumers.

- Seamlessness: The integration of digital signatures into workflows should be seamless, providing a frictionless experience for users and customers alike. This requires careful planning and execution to ensure that the transition between data collection, document review, and signing is smooth and intuitive.

- Security and Compliance: Any integration must prioritize security and compliance, ensuring that digital signatures meet the legal standards required in the organization's operating regions. This includes using digital signature solutions that provide robust authentication and encryption measures.

- Flexibility and Scalability: The integration should be flexible, allowing for adjustments to workflows as business needs evolve. It should also be scalable, ensuring that the digital signature solution can handle varying volumes of documents and data as the organization grows.

- User Adoption: Successful integration depends on user adoption. Organizations should choose digital signature solutions that are user-friendly and provide adequate support and training to ensure that all stakeholders can effectively use the system.

- Data Integration: The digital signature solution should integrate well with the organization's existing data infrastructure, allowing for the smooth flow of data between systems. This includes capabilities for data extraction, processing, and storage in a manner that supports the organization's data management practices.

The Bottom Line

The integration of digital signatures into insurance document workflows represents a pivotal step towards digital transformation in the industry. By enhancing efficiency, security, and customer satisfaction, digital signatures not only streamline operations but also position insurance companies for future growth and success. As the industry continues to evolve, the adoption of digital signatures will become increasingly essential, making it imperative for companies to explore and implement these solutions today.

For insurance companies looking to embark on this digital journey, partnering with experienced technology providers like EasySend can provide the necessary guidance, tools, and support to ensure a successful and seamless transition to digital-first document workflows.