In the digital era, insurance providers face a twofold challenge: adapting to evolving consumer expectations while navigating a highly competitive market landscape.

As digital transformation accelerates, insurers must harness digital tools and strategies to outpace competition.

Here’s a pathway to securing a competitive edge:

Adopt a customer-centric approach

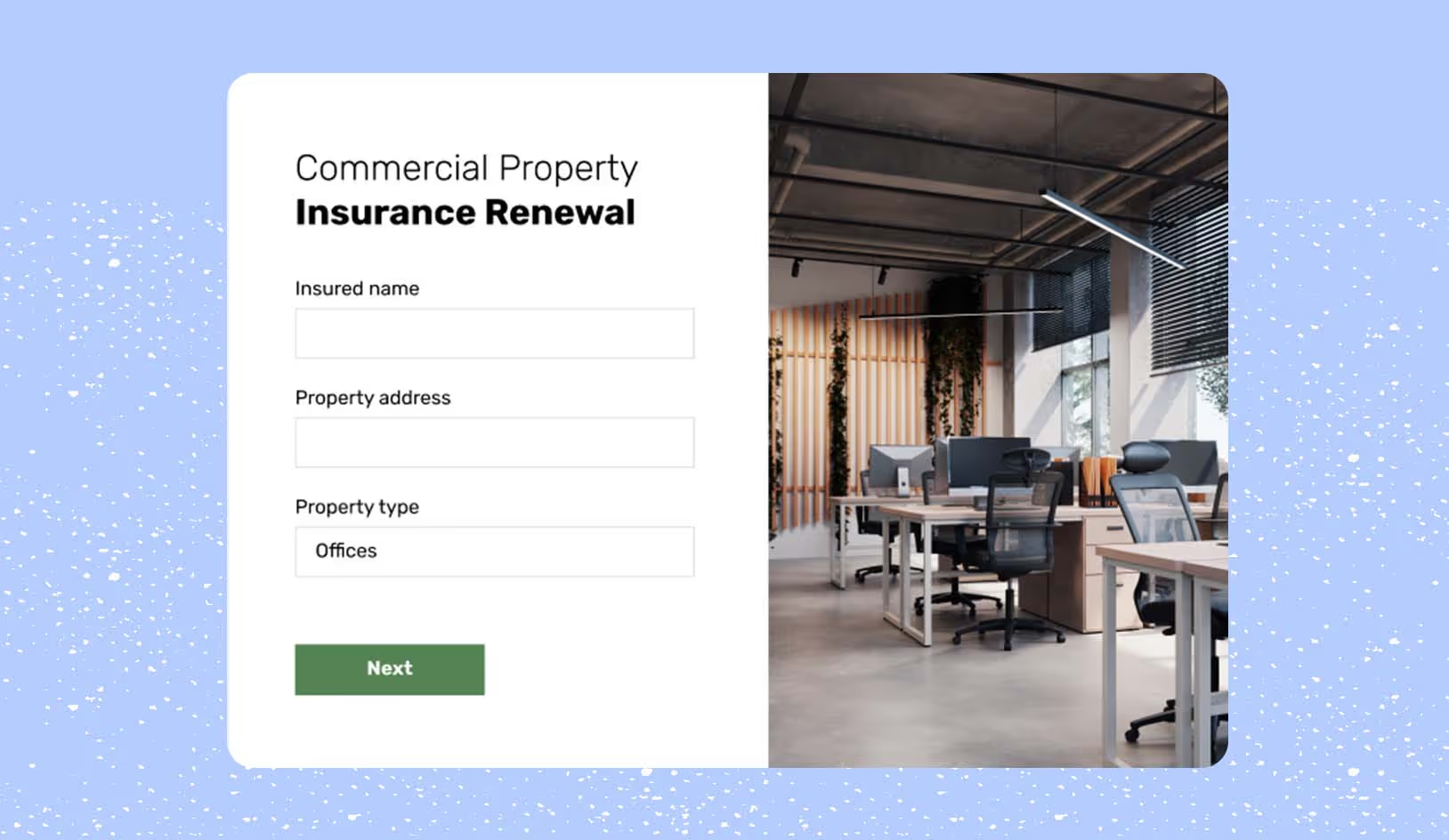

Understand and meet policyholders’ expectations by simplifying processes like claims filing and policy renewals through intuitive digital journeys.

What does it involve?

- Leveraging customer insights to personalize digital interactions

- Creating user-friendly online platforms for policy management

- Utilizing chatbots and other AI-powered tools to improve customer service

- Offering self-service options for tasks like document upload and policy changes

By prioritizing customer-centricity, insurers can build stronger relationships with policyholders and differentiate themselves from competitors.

Embrace data analytics

Data is the lifeblood of a successful digital strategy. With an unprecedented volume of data at their disposal, insurers can glean valuable insights into consumer behavior, market trends, and areas for improvement.

What does it involve?

- Utilizing predictive modeling to enhance risk assessment and pricing strategies

- Analyzing customer data to identify cross-selling and upselling opportunities

- Collecting real-time feedback through digital channels to inform product development

Data analytics can also streamline internal processes, saving time and resources while improving operational efficiency.

Harness the power of data

Data science goes beyond traditional data analytics, incorporating advanced technologies and techniques like machine learning and natural language processing.

What does it involve?

- Developing algorithms to automate underwriting processes

- Leveraging predictive modeling for fraud detection and prevention

- Utilizing sentiment analysis to improve customer experience

By embracing data science, insurers can make more informed decisions, reduce costs, and enhance the overall customer experience.

Leverage digital partnerships

Digital partnerships offer insurers access to cutting-edge technology and expertise without the need for significant investments in-house.

What does it involve?

- Collaborating with insurtech startups to develop innovative solutions

- Partnering with data analytics firms to gain deeper insights into consumer behavior

- Teaming up with tech companies for streamlined digital processes and improved customer experience

By leveraging digital partnerships, insurers can stay ahead of the curve in a rapidly evolving industry and continuously improve their digital strategy.

Embrace no-code development

Accelerate digital transformation by employing no-code platforms, which allow for the quick creation and optimization of digital processes even by non-technical staff. This approach reduces development time, lowers costs, and fosters innovation.

What does it involve?

- Utilizing drag-and-drop interfaces to build applications and workflows

- Creating automated processes without the need for coding knowledge

- Empowering employees across departments to develop digital solutions

By embracing no-code development, insurers can save time and resources while also promoting a culture of innovation within their organization. This approach allows for quick iteration and adaptation in response to changing customer needs and market trends.

Prioritize data security

As more data is collected and utilized to improve customer experience, insurers must prioritize data security to protect sensitive information from cyber threats. Data breaches can lead to significant financial losses, damage to reputation, and loss of consumer trust.

What does it involve?

- Implementing strong encryption methods for all data

- Conducting regular security audits and risk assessments

- Training employees on data security best practices

By prioritizing data security, insurers can ensure that their customers' information is safe and build trust by demonstrating their commitment to protecting their personal data.

Invest in Artificial Intelligence (AI)

Leveraging AI technology allows insurers to automate processes, gain valuable insights from large amounts of data, and improve customer experience through personalized interactions. AI can also help with fraud detection and risk assessment, leading to more accurate underwriting and pricing decisions.

What does it involve?

- Implementing AI-powered chatbots for customer support

- Utilizing machine learning algorithms for data analysis

- Investing in predictive modeling tools for risk assessment

By investing in AI technology, insurers can streamline operations, enhance customer experience, and gain a competitive advantage in the industry.

Invest in continuous improvement

Digital landscapes are ever-evolving; continuous refinement of digital processes is crucial to ensure they remain efficient, compliant, and user-friendly. Insurers must continually review and improve their digital systems to keep up with changing customer expectations and advancements in technology.

What does it involve?

- Regularly gathering feedback from customers and employees

- Conducting user testing to identify areas for improvement

- Staying updated on industry trends and implementing new technologies

By investing in continuous improvement, insurers can stay ahead of the curve and provide a seamless and user-friendly digital experience for their customers.

Cultivate a culture of innovation

Encourage collaboration and the free flow of ideas to drive digital innovation. Create an environment conducive to teamwork and innovative thinking, which can help develop solutions that differentiate you in the marketplace.

What does it involve?

- Providing resources and support for employees to explore new ideas

- Hosting regular brainstorming sessions or hackathons

- Encouraging a growth mindset and learning from failure

By fostering a culture of innovation, insurers can tap into the creativity and problem-solving abilities of their employees to drive digital transformation and stay ahead of competitors. This approach also fosters a sense of ownership and investment in the company's success, leading to increased employee satisfaction and retention.

Embrace automation

Automation can significantly improve efficiency, reduce costs, and minimize errors. However, it is essential to carefully consider which processes are best suited for automation to ensure effectiveness and avoid potential pitfalls.

What does it involve?

- Identifying repetitive or time-consuming tasks that could benefit from automation

- Evaluating and selecting appropriate technologies or tools

- Implementing proper training and support for employees to adapt to automated processes

By embracing automation, insurers can streamline operations and free up resources to focus on more complex tasks, ultimately improving customer service and satisfaction.

By integrating these strategies, insurance providers can significantly advance their digital transformation journey, ensuring they remain competitive in a digitally driven market. The focus should always be on delivering superior customer experiences, adapting to digital advancements, and fostering a culture of continuous improvement and innovation.