The integration of AI into commercial insurance underwriting is not just an incremental change but a foundational shift. With the advancements in technology and data analytics, AI is transforming traditional underwriting processes and radically improving accuracy, speed and efficiency, leading to better risk assessment, enhanced customer experiences and increased profitability for insurers.

This evolution is leading to more accurate risk assessments, personalized customer experiences, and ultimately, driving increased profitability for insurers specializing in commercial lines.

Enhanced risk assessment for diverse commercial needs

Commercial insurance is all about managing complex risk, and AI is playing an essential role in this area. With its ability to analyze and process vast amounts of data, AI can help insurers identify potential risks and prevent losses in commercial line policies:

- Sector-Specific Data Analysis: Commercial insurance covers a wide range of industries, each with its own risk profile. AI algorithms can analyze industry-specific data, such as manufacturing process data in industrial insurance or patient data in health insurance, to provide a more nuanced risk assessment.

- Tailored Coverage Options: AI enables insurers to offer customized insurance products that cater to the unique needs of different businesses, improving relevance and value to commercial clients.

Leveraging Big Data analytics with AI

One of the key ways AI is changing commercial insurance underwriting is through improved risk assessment. By leveraging vast amounts of structured and unstructured data, AI algorithms can quickly analyze and identify patterns that humans may miss. This allows for a more comprehensive and accurate risk assessment, resulting in better underwriting decisions.

Real-Time monitoring

In addition, AI can also provide real-time monitoring of risk factors, allowing for proactive risk management. For example, by continuously analyzing weather data and social media posts, AI can alert insurers to potential risks such as natural disasters or brand reputation damage. This enables insurers to take necessary actions to mitigate these risks, ultimately reducing potential losses and improving their bottom line.

Moreover, AI can assist insurers in detecting fraudulent activities by analyzing claims data and identifying suspicious patterns or behaviors. This not only saves time and resources but also helps insurers avoid paying out fraudulent claims.

Advanced fraud detection in high-value transactions

Another significant impact of AI in commercial insurance underwriting is its ability to detect fraudulent claims. By analyzing large datasets and identifying unusual patterns or behaviors, AI algorithms can flag potentially fraudulent activities for further investigation. This not only helps insurers save money by preventing fraudulent claims but also improves the overall accuracy and integrity of their underwriting processes.

- Complex Fraud Patterns Recognition: The high-value nature of commercial insurance claims makes it a target for sophisticated fraud schemes. AI’s advanced pattern recognition can identify complex fraud patterns that are difficult to detect manually.

Dynamic Pricing Models

Commercial risks are often dynamic and require constant reassessment. AI can support dynamic pricing models that adjust premiums based on real-time data, such as changes in a company's operation or market trends.

Insurers are leveraging AI to navigate complex decision-making processes. This includes the use of advanced analytics and edge capabilities, which aid in more accurate risk assessments and dynamic pricing strategies. AI's ability to process vast amounts of data rapidly facilitates quicker and more informed decision-making, leading to improved efficiency and customer satisfaction.

Operational efficiency in complex business environments

AI's advanced automation capabilities are also transforming commercial insurance underwriting by streamlining and optimizing various processes. This includes automating administrative tasks such as data entry, risk assessment, and documentation, freeing up underwriters' time to focus on more complex tasks. AI-powered chatbots can also assist with customer inquiries and claims processing, improving response times and overall customer satisfaction.

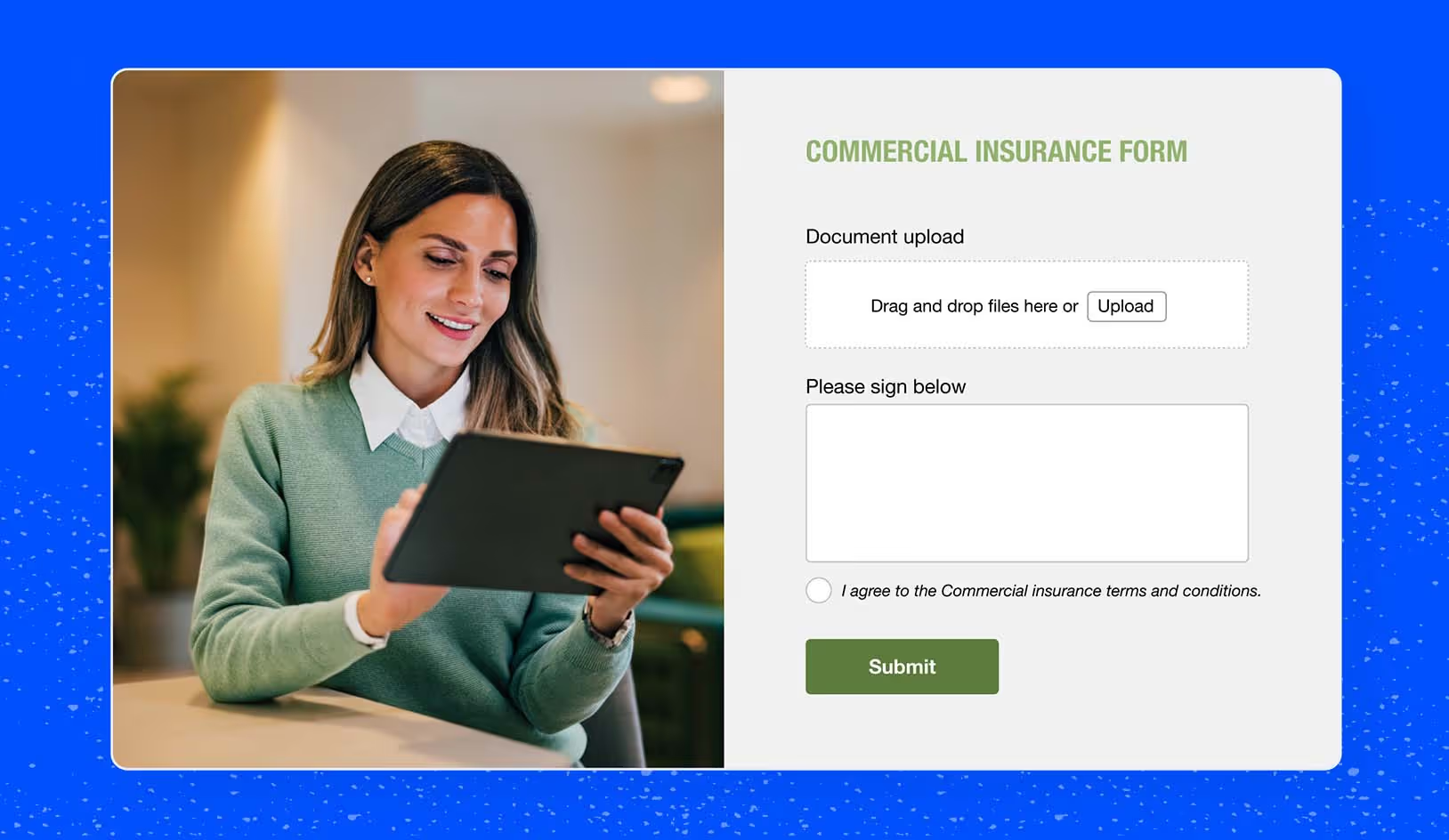

The technology is streamlining services and automating clerical tasks, thereby minimizing the risk of human error. This automation extends to everyday functions like filling out forms, filing insurance certificates, and checking policies.

AI is also playing a crucial role in reducing underwriting burnout. By automating manual and repetitive tasks, AI is alleviating the workload on underwriting teams, thus addressing the burnout crisis and mitigating talent shortages in the industry.

- Automating Complex Processes: In commercial insurance, underwriting involves more complex and variable factors than in personal lines. AI can automate the processing of complex data sets, such as business financials or supply chain information, enhancing underwriting efficiency.

Improved customer experience for business clients

In today's digital age, commercial line customers expect a seamless and personalized experience from their insurance providers. Yet, many commercial policies lag behind when it comes to digital customer experience.

- Streamlined Claim Processes for Businesses: AI can expedite the claims processing for businesses, which is often more complex due to the higher stakes and greater intricacy of commercial claims.

- Personalized Risk Management Advice: AI can analyze a company’s specific risk factors and provide tailored risk management advice, adding value beyond the insurance policy itself.

Moreover, AI can analyze vast amounts of data to identify patterns and predict future trends, helping insurers better understand their customers' needs and preferences. This allows them to offer tailored insurance products and personalized pricing options, increasing customer satisfaction and retention rates.

AI is revolutionizing the claims process by streamlining the entire journey, from filing a claim to receiving compensation. By automating document processing and utilizing computer vision, AI can accelerate the claims settlement process, reducing the time and effort required for both customers and insurers.

The Bottom Line

In the commercial insurance sector, AI is revolutionizing underwriting, enhancing data-driven decision-making, risk management, and customer experience. This technology is streamlining complex processes, offering dynamic pricing, and improving fraud detection, specifically tailored for diverse business needs.

AI stands as a transformative force in the realm of commercial insurance, steering the industry towards a more efficient, customer-centric, and data-oriented future. The benefits extend beyond just insurers and customers; they ripple out to the entire commercial ecosystem, fostering a more resilient, responsive, and innovative insurance landscape.