In the evolving landscape of insurance, meeting the varied and dynamic needs of customers has become crucial. The traditional methods of customer interaction often lead to frustration due to their rigidity and inefficiency. However, the integration of dynamic customer interaction systems in insurance is revolutionizing how insurers address customer pain points. This blog explores how these systems are making insurance processes more responsive, personalized, and efficient, thus significantly enhancing the customer experience.

Consequences of broken customer interactions in insurance

The lack of dynamic customer interaction solutions in the insurance sector leads to several significant pain points for customers today. These include:

- Delayed Response Times: Without automated and integrated customer interaction systems, insurers often struggle with slow response times. Customers are left waiting for answers to queries or updates on claims, leading to frustration and dissatisfaction. This delay is particularly problematic when customers seek urgent support, such as during emergencies or when immediate decisions are needed.

- Inconsistent Customer Experience Across Channels: In the absence of a unified platform that integrates various communication channels, customers may receive inconsistent information depending on where and how they contact their insurer. This inconsistency can lead to confusion and a lack of trust, as customers might receive different responses via email, phone, or online chats.

- Repetitive Interactions: Without systems that remember customer interactions across different channels, customers often have to repeat their information and issues every time they contact their insurer. This not only wastes time but also adds to customer frustration, particularly when dealing with complex issues that require multiple interactions.

- Lack of Personalization: Traditional interaction methods generally lack the capability to tailor experiences to individual customer preferences and histories. This one-size-fits-all approach fails to acknowledge the unique needs and past interactions of customers, making it difficult to build deeper customer relationships and loyalty.

- Inefficiency in Handling Routine Inquiries: Insurers without advanced interaction tools tend to handle even routine inquiries through human agents, which is time-consuming and often leads to bottlenecks during peak times. This inefficiency can be a significant drain on resources that could be better used addressing more complex customer needs.

- Proactive Service Limitations: The absence of predictive analytics and integrated data means insurers are less able to anticipate customer needs or identify potential issues before they arise. This reactive stance can prevent insurers from offering timely and relevant products or advice, potentially leading to missed opportunities for both the provider and the customer.

- Poor Data Management: Without robust data integration capabilities, managing and utilizing the vast amounts of data that flow through insurance transactions can be cumbersome and error-prone. This can lead to inaccurate risk assessments, policy errors, and a general decline in the quality of service provided.

Broken customer interactions in practice

Imagine Sarah, a busy professional who has recently experienced a minor car accident and needs to file an insurance claim. Here's how the lack of a dynamic customer interaction system complicates her experience, illustrating common pain points faced by many insurance customers today:

- Initial Contact and Data Repetition: Sarah calls her insurance provider to report the incident. She spends several minutes providing her personal details, policy number, and specifics of the incident. Later, when she uses the insurer's website to check the status of her claim, she has to re-enter all her information again because the digital platform isn't connected to the customer service center she initially contacted.

- Delayed Responses and Follow-Up: After submitting her claim, Sarah expects to receive timely updates via her preferred method—email. However, due to the lack of integrated communication tools within the insurance company, updates are slow. When she receives them, they're generic and don't address her specific concerns, leading to further follow-up calls where she again faces long wait times.

- Inconsistent Information Across Channels: During one of her follow-up calls, an agent provides her with an estimated time for her claim resolution. However, when she checks the online portal later, the information is inconsistent with what was told to her over the phone. This discrepancy makes her uncertain about the accuracy of the information and reduces her trust in the company's handling of her claim.

- Manual Processes and Lack of Proactivity: As her claim process drags on, Sarah discovers that a necessary document was missing from her initial submission. Unfortunately, the insurer’s system didn’t flag this at the start, nor did it proactively reach out to request the missing document. This oversight extends the claims process and requires Sarah to manually intervene to provide the necessary information, adding to her frustration.

- Resolution and Overall Experience: After weeks of back-and-forth, manual interventions, and inconsistent communication, Sarah’s claim is finally processed. However, the overall experience leaves her dissatisfied due to the excessive time spent on managing the claim, the lack of personalized communication, and the inconsistencies she encountered.

The urgent need for dynamic customer interaction layer

This scenario highlights the need for insurers to adopt more sophisticated, integrated, and customer-focused interaction systems. By implementing a dynamic customer interaction platform, insurance companies can automate routine tasks, ensure consistent and accurate information across all channels, provide real-time updates, and ultimately enhance the overall customer experience. Such improvements not only boost customer satisfaction but also streamline internal operations, making the claims process more efficient and less error-prone.

Personalization at Scale

One of the most significant pain points for insurance customers has been the "one size fits all" approach. Dynamic interaction platforms address this by enabling insurers to tailor interactions based on the specific needs and preferences of each customer. Whether it’s customizing communication methods or personalizing policy recommendations, these platforms ensure that every customer feels uniquely catered to.

Real-Time Responses

Gone are the days when customers had to wait days or even weeks for responses to their queries or claims. Dynamic customer interactions powered by real-time data processing allow insurers to offer immediate feedback and solutions to their clients. This responsiveness not only improves customer satisfaction but also enhances trust in the insurer’s ability to manage urgent issues efficiently.

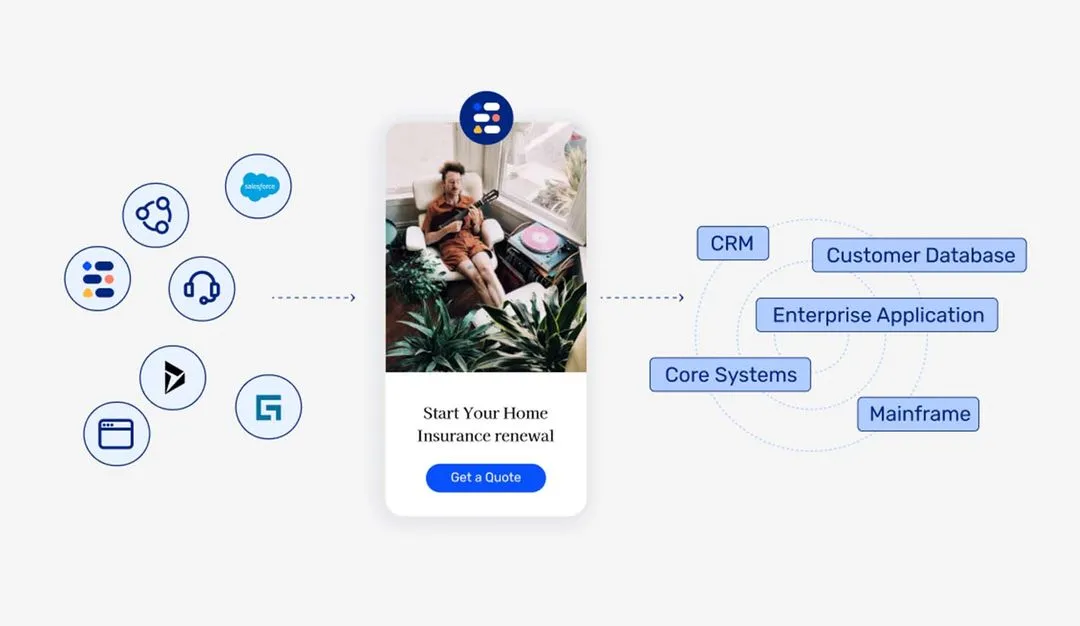

Multi-Channel Integration

Customers today expect to interact with their insurers across various platforms — from traditional phone calls to emails, online chats, and mobile apps. Dynamic customer interaction engines seamlessly integrate these multiple channels, providing a consistent and unified customer experience. This integration ensures that the customer can switch between channels without having to repeat information, reducing frustration and streamlining the communication process.

Automation of Routine Inquiries

A significant portion of customer dissatisfaction stems from the time spent handling routine inquiries that could be automated. Dynamic interaction systems employ AI and machine learning to automate these processes, such as verifying policy details or filing initial claims steps. This not only frees up customer service agents to handle more complex queries but also reduces the turnaround time for service requests, enhancing overall efficiency.

Proactive Customer Service

Dynamic interaction systems go beyond reactive service models by using data analytics to anticipate customer needs and potential issues before they become a problem. For example, if a customer’s driving behavior data indicates a potential for future claims, the system can proactively offer them safe driving tips or additional coverage options. This proactive approach not only prevents issues but also demonstrates the insurer’s commitment to their clients’ well-being.

The bottom line

The adoption of dynamic customer interaction systems in insurance is more than a technological upgrade; it’s a transformation in the philosophy of customer service. By addressing the direct pain points of customers and providing a responsive, personalized, and efficient service, insurers can significantly enhance customer satisfaction and loyalty. As these technologies continue to evolve, the potential for improving customer interaction in the insurance industry is boundless, promising a future where insurance is not just necessary but a genuinely supportive part of customers' lives.

This shift towards more dynamic and customer-focused interaction models is crucial in a competitive market where customer experience often dictates loyalty and retention. Insurers who leverage these advanced tools are setting new standards in customer care and redefining what it means to be a customer-centric organization.