Banking operations worldwide rely on comprehensive customer data collection to provide personalized service, stay compliant, and remain competitive. However, when data intake is manual and is based on an ad-hoc and unstructured process, it creates numerous challenges for banks in terms of accuracy, scalability, and security.

With so much at stake in an economic downturn, hardening competitive landscape, and shifting consumer expectations financial institutions must evaluate their data intake systems and consider switching to a more efficient, digital approach.

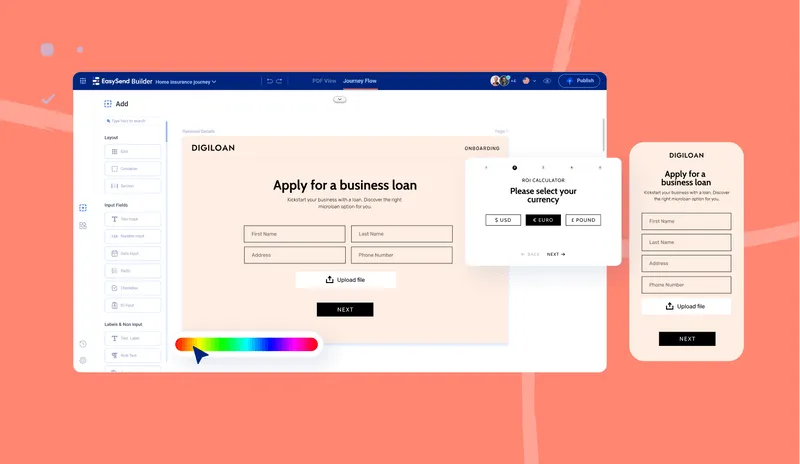

One solution to relieve and optimize the friction of manual data collection is digitized data intake. Using a centralized platform and automated processes, digital data intake streamlines collection, boosts efficiency, and improves customer experience.

Below are 13 indications that it’s time for your bank to transform your data collection process.

1. Inefficient manual processes

Traditionally, data collection for customer onboarding and banking activity documentation have been conducted via paper or PDF forms, emails, phone calls, and other unstructured and manual channels. Unfortunately, these processes are time-consuming, prone to errors, and require extensive resources to collect, verify, correct, and standardize the data.

In addition, manual data collection results in gaps that require back-and-forth communications with the customers, wasting valuable resources and causing friction. These types of data collection tasks are performed hundreds, if not thousands, of times daily across banking organizations. Without documented version control and with a high risk of user error.

If your customer-facing teams rely heavily on manual data entry, they end up spending an inordinate amount of time managing spreadsheet sprawl. It’s time to digitize your company’s data intake, which will help reduce costs, save time, speed up processes, and free up your employees for more important tasks.

2. Inconsistent data

Manual data entry results in inconsistent and inaccurate data, duplications, and discrepancies. As a result, customer service employees need to spend extra time correcting and resolving discrepancies and omissions, which requires significant time and effort.

Moreover, inconsistent and missing customer data makes it impossible to achieve a single, unified view of the customer. This, in turn, negatively impacts your business.

If your company is struggling to maintain consistency and accuracy in your data, digitization will help you ensure uniformity, standardization, and data integrity across the entire organization.

3. Lack of accessibility

When customer data isn’t easily accessible, bank employees are wasting time searching for the information they need to perform their duties efficiently. This results in delays and missed opportunities to cross-sell products and services.

Customers typically interact with several departments over the course of their customer journey. When each department uses different systems for storing data, accessing a customer’s complete data set can be extremely difficult, especially in larger banks.

If your data can’t be easily accessed by the people who need it, digitization is an excellent way to ensure centralized and secure access.

4. Slow data retrieval

When customer data is manually entered across different platforms, there’s no single, clear source of truth. As a result, retrieving reliable customer information is both frustrating and time-consuming.

Moreover, as the volume of data grows, outdated data collection technology results in scaling issues. If your company’s employees find themselves spending too much time searching for information, digitizing your data intake will have a significant impact on organizational efficiency.

5. Difficulty in tracking changes

Data can and inevitably will change over the course of a customer’s lifetime with your bank, whether that means a customer updating their address, buying new financial products and services, or their financial needs shifting over time.

Failing to track these changes can negatively impact your customers’ banking experience. After all, if a customer can’t trust your bank to keep their data current and updated at every touch point, how can they trust you to keep track of their money?

Manual data entry, siloed data systems, data volume, and inefficient data management processes are all factors that negatively impact your ability to keep track of your customer data. Digitization of customer data intake can provide the capabilities required to solve these issues, including version control, audit trail, a unified format, cross-platform integrations, and a cohesive data management process.

6. Inability to make data-driven decisions

A complete and accurate picture of your customer data is critical when making smart business decisions. Without the transparency and clarity, you can’t trust your data analytics and BI, which impedes your ability to make the right call.

The results can be disastrous, ranging from drawn-out or delayed go-to-market strategies for new services and products to outright losing customers to digitally mature competitors. Either way, it’s going to affect your bottom line.

Digitizing your customer data intake will provide better insights and analytics capabilities to inform your business strategy.

7. Difficulty in sharing data with others

Legacy technology and siloed systems only add to the problem. Without a standardized platform and format, keeping all stakeholders in sync isn’t only difficult, it can be downright impossible. This results in delays and inefficiencies when dealing with customers, frustrating everyone involved.

If your bank is struggling with data sharing internally or with external partners, transforming customer data intake will improve collaboration and communication across your organization.

8. Compliance concerns

Manual data intake makes it difficult for banks to demonstrate proper data management and protection in order to adhere to regulatory requirements.

A digital data intake system with an immutable audit trail will ensure compliance with the strict regulatory requirements and make it easy to share all the information with external auditors.

9. Difficulty in scaling operations

As the volume of customer data grows and becomes more complex, outdated, siloed technology systems slow down your progress and make it difficult to expand into new product lines and markets.

If you anticipate future growth and expansion in your bank, digitizing your data can provide scalability and future-proof your operations.

10. Data security concerns

Data breaches and other security incidents impact profitability, damage bank's reputation, and damage customer trust. Manual data collection as well as outdated, siloed technologies make it difficult for banks to guarantee that their customer data is safe and secure.

With the ongoing and increasing threat of data breaches, digitizing your data intake can provide enhanced security and protect sensitive information.

11. Lack of visibility into customer data

As a customer interacts with your bank, they’ll generate many data points across different business units and touchpoints. With manual data collection and siloed data management, chances are many stakeholders are struggling to get an accurate, cohesive view of your customer data.

If this is the case, digitization will provide the real-time access, visibility, and transparency required to ensure you can easily access the data you need.

12. Lack of integration & siloed systems

Without standardizing your data collection, syncing your customer data with analytics, BI, risk management, marketing, and other systems is going to be an expensive, resource-heavy, time-consuming challenge.

At best, you’ll end up with a cumbersome patchwork puzzle of solutions and an incomplete view of your customers. If your bank is facing difficulties keeping the data in sync between multiple siloed systems, digitization can provide seamless integration and improve data consistency.

13. High operational costs

Manual data intake results in out-of-control operational costs. Storing and managing documents, hiring additional staff to manually enter data into the internal systems all add up quickly.

By digitizing your data intake process, banks can reduce costs and optimize their operations.

Digitizing data intake impacts your entire organization

Digitization of customer data collection provides scalability for future growth, ensures real-time access to customer data to all stakeholders, enables enhanced integration between multiple systems, and provides a comprehensive view of the customer journey.

Consider implementing digital solutions for customer data intake if you want to stay competitive in today’s market and ensure high quality service for their customers.