In the fast-paced world of digital technology, even the age-old industry of insurance is feeling the ground shift beneath its feet. Right at the epicenter of this seismic shift is the process of underwriting. This cornerstone of insurance, where risks are measured, policies are priced, and coverage terms are determined, is being revolutionized thanks to the integration of digital data intake. The birth of this digital frontier is reshaping the landscape, making underwriting faster, more accurate, and incredibly efficient.

What is digital data intake

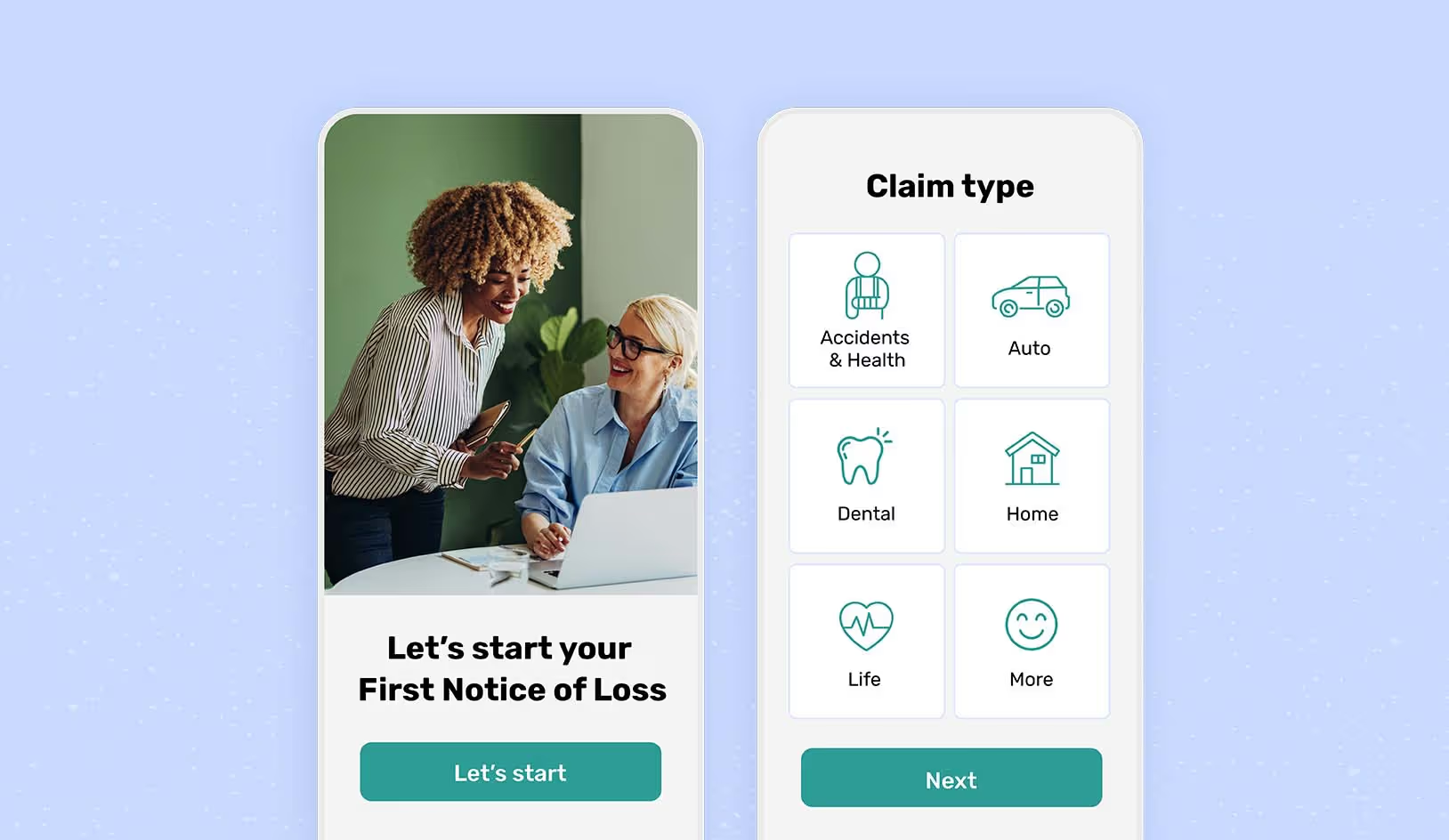

Digital data intake, in its simplest terms, is the collection of customer data through digital mediums like websites, mobile apps, and social media. This data, often a mix of personal details, preferences, and behavior patterns, is used to enhance customer experiences, tailor marketing efforts, and decipher trends in customer behavior.

There are several strategies for digital data intake:

- Active data intake: This is when prospective policyholders willingly provide data, typically while filling out an online form, navigating an app, or even interacting on a social media platform. Active data intake allows underwriters to get a direct understanding of the customer through forms filled during policy purchases.

- Passive data intake: In this method, data is captured subtly during customers' digital interactions, like browsing the insurer's website or using an application. Passive data intake helps insurance companies understand customers' behavior and interaction patterns, providing a broader context.

- Public data intake: This method involves harvesting digital data from public sources, like websites and social media, which may offer insights about a potential client. Public data intake can provide additional useful information that can factor into the underwriting decision.

Transforming risk assessment

Digital data intake holds a pivotal role in the core business processes of insurance companies, especially in underwriting - the backbone of insurance operations. Underwriters need detailed and accurate data about a prospect to evaluate the risk associated with insuring them.

Traditionally, this information was gathered through manual processes such as paper forms and phone conversations. However, digital data intake has brought in a more streamlined, efficient, and accurate process.

The traditional method of data intake during the underwriting process often involved paper forms, manual data entry, and time-consuming correspondence with applicants for additional information. However, with digital data intake, insurers can automate these processes, leading to several key advantages.

Increased speed and efficiency

The most immediate impact of digital data intake is the increased speed and efficiency of the underwriting process. Automation eliminates the need for manual data entry, significantly reducing the time it takes to gather and process information. Applications can be evaluated more quickly, and policy issuance expedited, resulting in a better customer experience.

Improved accuracy

Human error in data entry or interpretation can lead to incorrect risk assessment and flawed underwriting decisions. Digital data intake mitigates these risks by automating data collection and processing, thereby reducing the chances of error.

Comprehensive risk analysis

Digital tools can ingest a broader range of data than would be feasible manually, from social media profiles to telematics data from connected devices. Advanced analytics can then be applied to this data, enabling a more comprehensive and nuanced risk assessment. Insurers can uncover patterns and correlations that might go unnoticed in a traditional assessment, allowing for more precise pricing and better risk management.

Enhancing decision-making

Digital data intake does more than streamline risk assessment—it also enhances the decision-making process in underwriting. Automation of repetitive tasks frees up time for underwriters to focus on the nuances of each application. Insurers can also use the insights gleaned from digital data intake to develop better customer segmentation, create more targeted marketing efforts, and improve their overall operational efficiency.

Real-time updates

Digital data intake allows for real-time updates to an applicant's data, ensuring underwriters have access to the most current information when making decisions. This is particularly valuable in dynamic risk scenarios, such as health or auto insurance.

Mid-term adjustments to existing policies can also be facilitated with digital data intake, allowing for more precise risk management and better customer service.

Streamlining third-party communications

Digital data intake has a profound impact on streamlining third-party communications in insurance underwriting, effectively reducing back-and-forth exchanges among policyholders, agents, third parties, and underwriters.

For instance, in the case of a motor insurance policy, the underwriting process may require the inspection of a vehicle by a third-party service provider. Traditionally, this would involve scheduling and coordinating inspections, followed by the physical exchange of inspection reports.

Today, with digital data intake, third-party inspectors can directly upload their findings into the insurer's system. The data becomes instantly available to underwriters, saving time and reducing the chances of communication errors.

In health insurance, underwriting often requires medical data from healthcare providers. Digital data intake allows for the seamless transfer of electronic health records directly from the healthcare provider to the insurance company. This not only expedites the process but also ensures the accuracy of data, as it eliminates manual data entry errors.

Moreover, digital data intake provides agents and policyholders with real-time updates on the underwriting process, fostering transparency. This digital transformation is minimizing delays, reducing potential miscommunication, and enhancing the overall experience for all parties involved.

The bottom line

In conclusion, digital data intake is reshaping the underwriting process, bringing unprecedented speed, accuracy, and depth to risk assessment and decision-making. As insurers continue to navigate the digital transformation journey, harnessing the power of digital data intake will be crucial for staying competitive and delivering superior customer experiences. With technology advancing at a rapid pace, the possibilities for further enhancing the underwriting process are boundless, promising a future where insurance is more personalized, accurate, and efficient than ever before.